PROTECT YOUR ASSETS.

INVEST FOR THE FUTURE.

PROTECT YOUR ASSETS. INVEST FOR THE FUTURE.

A TEAM APPROACH.

At 1865 Wealth Advisors, our trust professionals, and 1865 Investment Services financial advisors are eager to work with you to customize an asset management strategy that matches your goals and objectives. Our heritage of stability, consistency and superior performance has earned us a reputation for providing reliable, unbiased advice for generations of families. As we help you and your family reach your financial goals, our philosophy is simple – we treat your money as if it were our own.

WE TREAT YOUR MONEY AS IF IT WERE OUR OWN.

Our bank partners develop holistic strategies tailored to meet your goals. Some professionals focus on one specific area, we focus on you. We will develop a plan to help you work toward your goals and adapt your plan as circumstances change.

OUR VALUES.

Our investment and trust professionals are eager to work with you to customize an asset management strategy that matches your goals and objectives. Our highly-focused team approach leverages the expert guidance of the 1865 Wealth Advisors.

Our heritage of stability, consistency and superior performance has earned 1865 Wealth Advisors a reputation for providing reliable, unbiased advice for generations of families. As we help you and your family reach your financial goals, our philosophy is simple – we treat your money as if it were our own.

OUR SERVICES COMPLIMENT AND ENHANCE

OUR SERVICES COMPLIMENT AND ENHANCE YOUR ONGOING STRATEGY.

YOUR ONGOING STRATEGY.

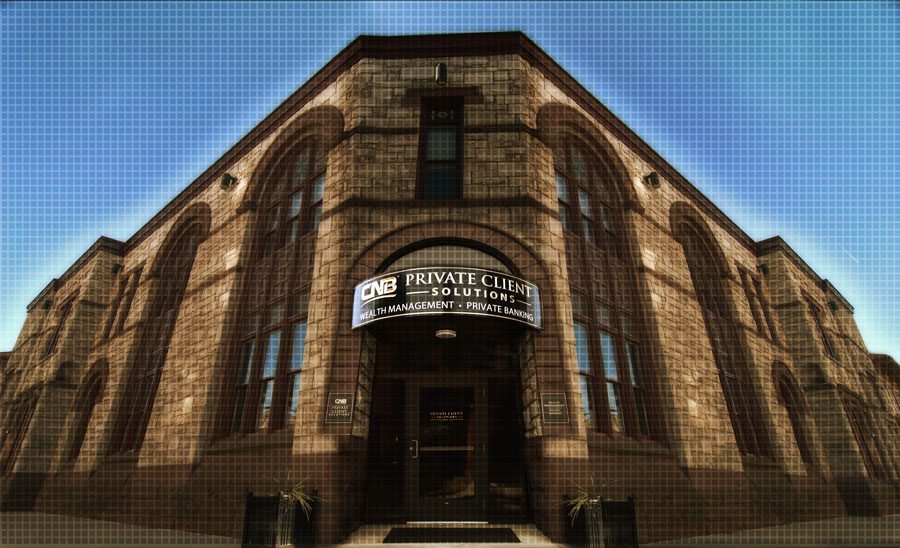

YOUR LOCAL FINANCIAL PARTNERS.

* We have a partnership with Ameriprise Financial Services to provide financial planning services and solutions to our clients. We are not an investment client of Ameriprise, but we have a revenue sharing relationship with them that creates a conflict of interest. Details on how we work together can be found on ameriprise.com/sec-disclosure.

| Not FDIC or NCUA Insured | No Financial Institution Guarantee | May Lose Value |

Ameriprise Financial Services, LLC is not an FDIC insured bank; FDIC insurance only covers the insolvency of FDIC-insured banks.

Ameriprise Financial cannot guarantee future financial results.

Ameriprise Financial Planning Services are optional, offered separately, and priced according to the complexity of your case and your financial advisor’s practice fee schedule. Your fees and financial advisor may be subject to change.

Financial planning is generally appropriate if you have financial goals, sufficient assets and income to address your financial goals, and are willing to pay an investment advisory fee for recommendations to help you achieve those goals. Please review the Ameriprise Financial Planning Client Disclosure Brochure or, for a consolidated advisory relationship, the Ameriprise Managed Accounts and Financial Planning Service Disclosure Brochure, for a full description of services offered, including fees and expenses.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

1865 Investment Services is a financial advisory services of Ameriprise Financial Services, LLC.

Trust & Estate Services, Business Investment Services, and Personal Services are offered by certain representatives of 1865 Wealth Advisors and not through or in association with Ameriprise Financial Services, LLC.

1865 Wealth Advisors and trust professionals are not affiliated with Ameriprise Financial, Inc.

Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

© 2025 Ameriprise Financial, Inc. All rights reserved.